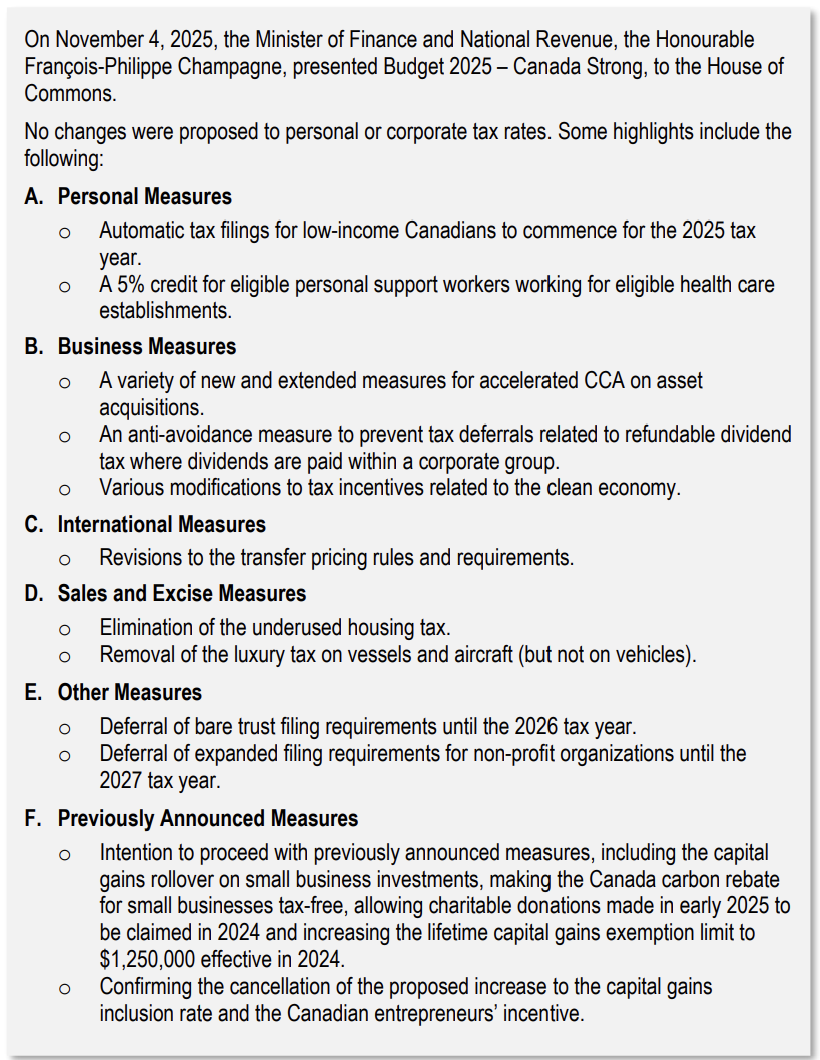

Federal Budget Commentary 2025

A. Personal Measures

Automatic Federal Benefits for Lower-Income Individuals

Budget 2025 proposed to provide CRA with the discretionary authority to file a tax return on behalf of an individual who meets all of the following criteria:

- the individual would have no taxes on a federal tax return after considering only the basic personal amount, plus any age and disability credits they are entitled to;

- all income of the individual for the taxation year is from sources for which specified information returns have been filed with CRA;

- the individual has not filed a tax return for at least one of the three immediately preceding taxation years; and

- the individual has otherwise not filed a return for the taxation year prior to, or within 90 days following, the tax filing deadline for the year.

CRA may also implement any other criteria as appropriate.

Prior to filing a return, the individual would be provided with the tax information reflected by CRA for their review. The individual would have 90 days to confirm or update it. If they take no action, CRA could file the return, issue a notice of assessment, and determine any credit or benefit entitlements.

In some cases, CRA may need the individual to confirm basic details, such as marital status, before issuing benefits. Some benefits also require a return from the spouse or common-law partner, which CRA could also file if the eligibility criteria are met.

The existing assessment, objection, and appeal processes would apply to assessments issued under these provisions. If it is determined after a tax return has been filed by CRA that the taxpayer did not meet the requirements for automatic tax filing, the tax return would be deemed not to have been filed.

Individuals would be able to opt out of automatic tax filing.

This measure would apply to the 2025 and subsequent taxation years. That is, filing could begin in 2026.

Interested parties can send comments to autotaxfiling-autoimpot@fin.gc.ca by January 30, 2026.

Temporary Personal Support Workers Tax Credit

Budget 2025 proposed to provide eligible personal support workers working for eligible health care establishments with a refundable tax credit of 5% of eligible earnings (providing a credit of up to $1,100). Amounts earned in British Columbia, Newfoundland and Labrador and the Northwest Territories would not be eligible, as federal funding is already provided to increase personal support workers’ wages in these jurisdictions.

To qualify, the person must ordinarily provide one-on-one care and essential support to optimise and maintain another individual’s health, well-being, safety, autonomy and comfort, consistent with that individual’s health care needs as directed by a regulated health care professional or a provincial community health organization. The person’s main employment duties must include helping patients with activities of daily living and mobilization.

The person must work for an eligible health care establishment, which would be hospitals, nursing care facilities, residential care facilities, community care facilities for the elderly, home health care establishments and other similar regulated health care establishments.

Eligible earnings would include all taxable employment income, including wages and salaries, and employment benefits (as well as similar tax-exempt income and benefits earned on a reserve) that is earned as an eligible personal support worker performing employment duties for eligible health care establishments.

Employers would need to certify their employees’ eligible earnings in prescribed form and manner.

Individuals would need to file a tax return to be eligible. This measure would apply to the 2026 to 2030 taxation years.

Top-Up Tax Credit

The lowest marginal personal tax rate is being reduced to 14.5% for the 2025 taxation year, and to 14% for the 2026 and subsequent taxation years. This rate is also applied to most non-refundable tax credits. In very rare cases where an individual’s non-refundable tax credit amounts exceed the first income tax bracket threshold ($57,375 in 2025), the decrease in the value of these credits may exceed their tax savings from the rate reduction.

Budget 2025 proposed to introduce a new non-refundable top-up tax credit, which would effectively maintain the current 15% rate for non-refundable tax credits claimed on amounts in excess of the first income tax bracket threshold.

The top-up tax credit would apply for the 2025 to 2030 taxation years.

Qualified Investments for Registered Plans – Small Businesses

Budget 2025 proposed to simplify and streamline the rules relating to registered plan investments in small businesses, while maintaining the ability of registered plans to make such investments.

In particular, RDSPs would be permitted to acquire shares of specified small business corporations, venture capital corporations and specified cooperative corporations (as is currently allowed for RRSPs, RRIFs, TFSAs, RESPs and FHSAs). In addition, shares of eligible corporations and interests in small business investment limited partnerships and small business investment trusts would no longer be qualified investments (for RRSPs, RRIFs, RESPs and DPSPs).

These amendments would apply as of January 1, 2027. Interests in small business investment limited partnerships and small business investment trusts that are acquired before 2027 under the current rules would continue to be qualified investments. The government noted that it is intended that shares of eligible corporations would continue to be qualified investments under the rules relating to specified small business corporations.

Budget 2025 also proposed to make a number of other technical legislative amendments to simplify the qualified investment rules. Notably, the qualified investment rules for six types of registered plans (i.e. all plans except DPSPs) would be consolidated into one definition in the Income Tax Act.

Home Accessibility Tax Credit Modification

Budget 2025 proposed to prohibit an expense claimed under the medical expense tax credit from also being claimed under the home accessibility tax credit. Under existing law, if the eligibility criteria for both credits are met, taxpayers can claim both credits in respect of the same expense.

This measure would apply to the 2026 and subsequent taxation years.

Canada Carbon Rebate Payments to Individuals – Program Wind-up

With the removal of the federal consumer carbon tax as of April 1, 2025, the government provided a final quarterly payment starting in April 2025 to eligible households. To support the winding down of mechanisms to return fuel charge proceeds, Budget 2025 proposed to provide that no payments would be made in respect of tax returns, or adjustment requests, filed after October 30, 2026.

Canada Disability Benefit – One-time Supplemental Payment

Budget 2025 proposed to provide a one-time supplemental Canada disability benefit payment of $150 in respect of each disability tax credit certification, or re-certification, giving rise to a Canada disability benefit entitlement, retroactive to the launch of the Canada disability benefit. Following the successful completion of the regulatory process, the first supplemental payments are expected to be made to recipients before the end of 2026-27.

B. Business Measures

Accelerated Capital Cost Allowance (CCA)

The CCA system determines the deductions that a business may claim each year for income tax purposes in respect of the capital cost of its depreciable property. Depreciable property is divided into CCA classes with each having its own rate, generally aligning with the expected useful life of the assets.

Budget 2025 referred to a series of proposals to allow accelerated CCA, many announced previously, as the “productivity super-deduction.”

Accelerated Investment Incentive (AII) Extended

Budget 2025 confirmed that the 2024 Fall Economic Statement proposal to reinstate the AII, including accelerated first-year CCA for manufacturing or processing equipment, clean energy generation and energy conservation equipment and zero-emission vehicles, would proceed. All of these incentives began to be phased out in 2024. The reinstatement of the incentives would begin for assets acquired on or after January 1, 2025. The current and proposed rates are summarized as follows:

| Accelerated investment incentive (subject to half-year rule) (2) | Manufacturing or processing machinery and equipment, clean energy generation and energy conservation equipment and zero-emission vehicles (1) (2) | |||

| Current | Proposed | Current | Proposed | |

| 2023 | 3x normal CCA | N/A | 100% | N/A |

| 2024 | 2x normal CCA | N/A | 75% | N/A |

| 2025 | 2x normal CCA | 3x normal CCA | 75% | 100% |

| 2026 – 2027 | 2x normal CCA | 3x normal CCA | 55% | 100% |

| 2028 – 2029 | normal CCA | 3x normal CCA | normal CCA | 100% |

| 2030 – 2031 | normal CCA | 2x normal CCA | normal CCA | 75% |

| 2032 – 2033 | normal CCA | 2x normal CCA | normal CCA | 55% |

| 2034 onwards | normal CCA | normal CCA | normal CCA | normal CCA |

- manufacturing or processing machinery and equipment (class 53 until 2025, class 43 thereafter), clean energy generation and energy conservation equipment (class 43.1 and class 43.2 for property acquired before 2025) and zero-emission vehicles (classes 54, 55, and 56)

- Normal CCA refers to the typical first-year CCA claim when no incentive was available, including application of the half-year rule. For example, normal CCA for a class 8 asset is 20% subject to the half-year rule. So, normal first-year CCA is 10%, with the current 2025 rate being 20% (2*10%) and the proposed rate being 30% (3*10%).

In summary, the proposal would restore the enhanced first-year CCA claims that had started to phase out for assets acquired in 2024, ensuring that the full incentives would apply to assets acquired in the calendar years 2025 to 2029. The existing scheduled phaseout from 2024 to 2027 would instead occur from 2030 to 2034.

Immediate Expensing for Manufacturing and Processing Buildings

Eligible buildings in Canada used to manufacture or process goods for sale or lease (manufacturing or processing buildings) have a CCA rate of 10% provided that at least 90% of the building’s floor space is used in manufacturing or processing.

Budget 2025 proposed to provide immediate 100% CCA expensing of the cost of eligible manufacturing or processing buildings, including eligible additions or alterations made to such buildings, provided the minimum 90% floor space requirement is met.

Property that has been used, or acquired for use, for any purpose before it is acquired by the taxpayer would be eligible for immediate expensing only if neither the taxpayer nor a non-arm’s-length person previously owned the property and the property was not transferred to the taxpayer on a tax-deferred “rollover” basis.

In cases where a taxpayer benefits from immediate expensing of a manufacturing or processing building, and the use of the building is subsequently changed, recapture rules may apply.

This measure would be effective for eligible property that is acquired on or after November 4, 2025 and is first used for manufacturing or processing before 2030. An enhanced first-year CCA rate of 75% would be provided for eligible property that is first used for manufacturing or processing in 2030 or 2031, and a rate of 55% would be provided for eligible property that is first used for manufacturing or processing in 2032 or 2033. The enhanced rate would be phased out entirely for property that is first used for manufacturing or processing after 2033.

Reinstatement of Accelerated CCA for Low-Carbon Liquefied Natural Gas Facilities

An accelerated CCA measure for liquefied natural gas (LNG) equipment and related buildings expired at the end of 2024. The measures increased the CCA rate for liquefaction equipment from 8% to 30% and for non-residential buildings used in LNG facilities from 6% to 10%. Budget 2025 proposed reinstating accelerated CCAs for LNG equipment and related buildings, but only for low-carbon LNG facilities.

Details regarding the new emissions performance requirements for these additional allowances will be provided at a later date. These measures would apply to property acquired on or after November 4, 2025 and before 2035.

Productivity-Enhancing Assets

Budget 2025 confirmed that a Budget 2024 proposal to provide immediate 100% CCA expensing of the cost of property acquired on or after April 16, 2024 that becomes available for use before January 1, 2027 will proceed. Assets in the following three classes would be eligible:

- class 44 (patents or the rights to use patented information for a limited or unlimited period);

- class 46 (data network infrastructure equipment and related systems software); and

- class 50 (general-purpose electronic data-processing equipment, such as computers and systems software).

This immediate expensing would only be available for the year in which the property becomes available for use. The claim would be prorated when the taxation year is less than 12 months.

Dividend Refund – Tiered Corporate Structures

The Income Tax Act includes rules that seek to prevent the use of Canadian-controlled private corporations (CCPC) to defer personal income tax on investment income. Investment income earned by a CCPC is subject to an additional refundable tax that increases the corporation’s tax rate to approximate the highest marginal combined federal-provincial personal income tax rate. A corporation is entitled to a refund of a portion of this additional tax when it pays a taxable dividend, referred to as a dividend refund.

A corporation is generally not subject to income tax on a taxable dividend received from a connected corporation (generally, a corporation that owns shares carrying more than 10% of the votes and value of the payer corporation), except to the extent that the corporation paying the dividend (Payerco) received a dividend refund. In those cases, the corporate shareholder (Receiveco) is subject to a tax equal to the dividend refund received by Payerco, multiplied by Receiveco’s portion of the total dividends paid by Payerco. For example, if Payerco paid a $100,000 dividend and received a $10,000 dividend tax refund, and Receiveco’s dividend received from Payerco was $20,000, Receiveco would pay $2,000 of tax on the dividend. This tax would also be refundable when Receiveco pays dividends.

The government is concerned that tax planning techniques have been employed to take advantage of a timing difference where Payerco and Receiveco have different year-ends. For example, Payerco might pay a taxable dividend on October 25, 2025 and receive a dividend refund for its tax year ended on October 31, 2025. If Receiveco’s year-end is August 31, it would not be subject to the tax on its dividend received until its August 31, 2026 year-end, resulting in a 10-month deferral of tax.

Budget 2025 proposed to limit the deferral of tax in corporate structures with mismatched year-ends. In general terms, the proposed limitation would suspend Payerco’s dividend refund on the payment of a taxable dividend to Receiveco where two conditions are met. First, the suspension would apply only if Receiveco and Payerco are affiliated corporations. Second, the suspension would apply only if a tax deferral such as the one described in the example above will otherwise be achieved. Specifically, the suspension would apply if Receiveco’s taxes payable for the year in which it received the dividend are due later than Payerco’s taxes are due for the year in which it paid the dividend. Payerco would generally be entitled to claim the suspended dividend refund in a subsequent taxation year when Receiveco pays a taxable dividend to a non-affiliated corporation or an individual shareholder.

If Payerco’s dividend refund is suspended in this manner, Receiveco would not be required to pay the tax described above in respect of the dividend.

The dividend refund would not be suspended in Payerco if each Receiveco in the chain of affiliated corporations pays a subsequent dividend on or before the date on which Payerco’s taxes are due, as no deferral would result for the affiliated corporate group. The rule would also not apply to a Payerco that is subject to an acquisition of control within 30 days after the dividend payment.

This measure would apply to taxation years that begin on or after November 4, 2025.

The proposed new rules are complex. A detailed review of the structure of corporate groups will be required to determine situations where dividend refunds will be delayed, and to assess any changes in historical dividend strategies to minimize the impact of this proposal. As the details of the proposal may change during the legislative process, it will be preferable to delay this review until dividend planning is being done for fiscal years that will be affected by these proposals.

Scientific Research and Experimental Development (SR&ED)

Under the SR&ED tax incentive program, qualifying expenditures are fully deductible in the year they are incurred. Additionally, these expenditures are generally eligible for an investment tax credit.

The tax credit is provided at two rates. A fully refundable tax credit at an enhanced rate of 35% is available for Canadian-controlled private corporations (CCPCs) on up to $3 million of qualified SR&ED expenditures annually. The $3 million expenditure limit is gradually phased out where a CCPC’s taxable capital employed in Canada for the previous taxation year is between $10 million and $50 million. This limit is shared within an associated group of corporations.

A non-refundable tax credit at the general rate of 15% is available for corporations other than CCPCs and for qualified SR&ED expenditures of CCPCs that do not qualify for the enhanced credit.

The 2024 Fall Economic Statement proposed the following additional changes to the SR&ED program:

- increase the expenditure limit from $3 million to $4.5 million;

- increase the lower and upper prior-year taxable capital phase-out boundaries to $15 million and $75 million, respectively;

- restore the eligibility of SR&ED capital expenditures for both the deduction against income and investment tax credit components of the SR&ED program; and

- extend the enhanced tax credit to eligible Canadian public corporations.

Budget 2025 confirmed that these proposed measures would proceed.

In addition, Budget 2025 proposed to further increase the expenditure limit on which the SR&ED program’s enhanced 35% tax credit can be earned, from the previously announced $4.5 million to $6 million.

These measures would apply for taxation years that begin on or after December 16, 2024 (i.e. the date of the 2024 Fall Economic Statement).

Worker Misclassification – Employee vs Independent Contractor

The government is concerned that the deliberate misclassification of employees as independent contractors means that employers are not withholding and remitting the proper amounts of income tax, CPP and EI contributions. Misclassified employees may lose out on labour law protections, as well as benefits and pensions available to employees.

Trucking sector

The government noted that this misclassification of employees has been particularly common in the trucking industry.

Budget 2025 proposed to provide $77 million over 4 years starting in 2026-27, with ongoing funding of $19.2 million annually, for CRA to implement a program that addresses non-compliance related to personal services businesses, as well as to lift the moratorium on reporting fees for services in the trucking industry.

Information sharing

Budget 2025 also proposed to amend the Income Tax Act and the Excise Tax Act to allow CRA to share information with the Department of Employment and Social Development Canada for the purpose of addressing worker misclassification.

This measure would come into force on royal assent of the enacting legislation.

Agricultural Cooperatives: Patronage Dividends Paid in Shares

Prior to 2005, patronage dividends paid in shares by an agricultural cooperative to its members were taxable to the members in the year the shares were received. The cooperative paying the dividend was also required to withhold an amount from the dividend and remit it to CRA on account of the recipient’s tax liability.

A temporary deferral of income taxes and withholding obligations on patronage dividends received from agricultural cooperatives by their members in the form of eligible shares until the disposition (including a deemed disposition) of the shares has been in place since 2005, and was set to expire at the end of 2025. Budget 2025 proposed to extend this measure to apply in respect of eligible shares issued before the end of 2030, a five-year extension.

Clean Economy Tax Incentives

Budget 2025 announced a number of amendments and enhancements to tax incentives related to the clean economy.

Critical Mineral Exploration Tax Credit (CMETC)

Budget 2025 proposed to expand the eligibility of the 30% CMETC to include the following additional critical minerals: bismuth, cesium, chromium, fluorspar, germanium, indium, manganese, molybdenum, niobium, tantalum, tin and tungsten. This credit is available in respect of Canadian exploration expenses (CEE), including Canadian renewable and conservation expenses (CRCE) and Canadian development expenses (CDE) flowed out to individuals who invest in flow-through shares.

The following critical minerals are currently eligible for the CMETC: nickel, cobalt, graphite, copper, rare earth elements, vanadium, tellurium, gallium, scandium, titanium, magnesium, zinc, platinum group metals, uranium and lithium (including lithium from brines).

This measure would apply to expenditures renounced under eligible flow-through share agreements entered into after November 4, 2025 and on or before March 31, 2027.

Clean Technology Manufacturing Investment Tax Credit

Budget 2025 proposed to expand the list of critical minerals eligible for the 30% clean technology manufacturing investment tax credit to include antimony, indium, gallium, germanium and scandium. This refundable investment tax credit applies to investments in new machinery and equipment used to manufacture or process key clean technologies, or to extract, process, or recycle critical minerals essential for clean technology supply chains, currently including lithium, cobalt, nickel, graphite, copper and rare earth elements.

This measure would apply in respect of property that is acquired and becomes available for use on or after November 4, 2025.

Carbon Capture, Utilization and Storage (CCUS) Investment Tax Credit (ITC)

The CCUS ITC provides three different credit rates depending on the purpose of the equipment, with the following credit rates applying to eligible CCUS expenditures incurred from the start of 2022 to the end of 2030, declining for eligible expenditures that are incurred from the start of 2031 to the end of 2040:

- 60% (declining to 30%) for eligible capture equipment used in a direct air capture project;

- 50% (declining to 25%) for all other eligible capture equipment; and

- 37.5% (declining to 18.75%) for eligible transportation, storage and use equipment.

The extent to which the CCUS tax credit is available to a CCUS project and respective eligible equipment depends on the end use of the carbon dioxide (CO2) being captured. Eligible uses include dedicated geological storage and storage in concrete, but not enhanced oil recovery (EOR).

Budget 2025 proposed to extend the availability of the full credit rates by 5 years, so that the full rates apply to eligible expenditures incurred from the start of 2022 to the end of 2035, declining to the lower rates for eligible expenditures that are incurred from the start of 2036 to the end of 2040. A previously announced review of the CCUS investment tax credit rates will be undertaken before 2035 (rather than before 2030).

Clean Electricity Investment Tax Credit (ITC) and Canada Growth Fund

Budget 2025 proposed to include the Canada Growth Fund as an entity eligible for the 15% clean electricity ITC. Budget 2025 also proposed to introduce an exception so that financing provided by the Canada Growth Fund would not reduce the cost of eligible property for the purpose of computing the clean electricity ITC available to other entities. These measures would apply to eligible property that is acquired and that becomes available for use on or after November 4, 2025.

C. International Measures

Transfer Pricing

Transfer pricing rules are used to allocate profit among the various entities of a multinational enterprise (MNE) group. The accepted international standard is the arm’s length principle set out in Article 9 (Associated Enterprises) of the Organisation for Economic Co-operation and Development (OECD) Model Tax Convention on Income and Capital and included in Canada’s bilateral tax treaties. In addition, the OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations (the “OECD Transfer Pricing Guidelines”) present internationally agreed principles and provide guidelines for the application of the arm’s length principle.

Budget 2025 proposed to modernise Canada’s transfer pricing rules to better align with the international consensus on the application of the arm’s length principle. In addition, an interpretation rule would be added to ensure that Canada’s transfer pricing rules are applied in a manner consistent with the analytic framework set out by the OECD Transfer Pricing Guidelines. The new rules would provide more detail on how cross-border transactions between non-arm’s length persons must be analysed. A new transfer pricing adjustment application rule would apply if two conditions are met: (i) there is a transaction or series of transactions between a taxpayer and a non-resident person with whom the taxpayer does not deal at arm’s length; and (ii) the transaction or series (once it has been analysed and determined) includes actual conditions different from arm’s length conditions. The actual conditions are determined not only by the contractual terms of the transaction or series, but also by other “economically relevant characteristics,” including the conduct of the participants.

The intention of transfer pricing analysis is to determine the price that would have been charged between arm’s length parties in comparable circumstances, taking into account the options realistically available to them at the time of entering into the transaction or series. The arm’s length price is the fair market value that should be charged, and the tax authorities can reassess taxpayers transacting at other values.

In addition to modifying the manner in which acceptable transfer prices must be determined, the new rules would modify certain administrative measures. These include the following items:

- increasing the threshold for the transfer pricing penalty to apply from a $5 million transfer pricing adjustment to a $10 million adjustment;

- clarifying the transfer pricing documentation requirements and also more closely aligning them with the new definitions and the requirements to select and apply the most appropriate method;

- providing for simplified documentation requirements when prescribed conditions are met; and

- reducing the time to provide transfer pricing documentation from 3 months to 30 days (the requirement for taxpayers and partnerships to make or obtain the appropriate records or documentation by their documentation-due date, generally the due date for their tax return for the year in which the transactions occurred, would remain unchanged).

This measure would apply to taxation years that begin after November 4, 2025.

D. Sales and Excise Measures

Underused Housing Tax (UHT)

Budget 2025 proposed to eliminate the UHT (which first took effect on January 1, 2022) as of the 2025 calendar year. No UHT would be payable and no UHT returns would be required in respect of the 2025 and subsequent calendar years. Filing requirements, penalties and interest in respect of prior periods would not be removed.

Luxury Tax on Aircraft and Vessels

Budget 2025 proposed to end the luxury tax on subject aircraft and subject vessels. All instances of the tax would cease to be payable after November 4, 2025. Registered vendors in respect of these items would be required to file a final return. The tax would remain applicable to vehicles (such as cars and SUVs) with a value above $100,000.

Carousel GST/HST Frauds

Carousel schemes use a series of real or fraudulent transactions where at least one person collects GST/HST in respect of a supply of property or services but does not remit the amounts to the government.

Budget 2025 proposed changes to help prevent these schemes by introducing a new reverse charge mechanism (RCM) beginning with certain supplies in the telecommunications sector (such as providers of voice-over internet protocol, VoIP, services).

Under the proposed new rules, suppliers would not be required to collect the GST/HST payable on the supply. Instead, recipients would be required to self-assess and report the tax payable in their GST/HST return. If entitled, the recipient could claim an input tax credit (ITC) in the same return provided that they accounted for the GST/HST payable. This system appears to be intended to prevent the collection of GST/HST by parties that may not remit the funds to CRA.

The government will continue to monitor and assess the presence of carousel fraud in order to determine whether other supplies should also be subject to an RCM in the future.

Feedback on these proposals can be submitted by email to Consultation-Legislation@fin.gc.ca by January 12, 2026.

Manual Osteopathic Services

Budget 2025 proposed to clarify that osteopathic services rendered by individuals who are not osteopathic physicians are taxable under the GST/HST regime. This measure would apply to supplies made after June 5, 2025. However, it would not apply to a supply of osteopathic services made from June 6, 2025 to November 4, 2025 if the supplier did not charge, collect or remit any amount as or on account of tax in respect of the supply.

E. Other Measures

Bare Trust Filings

Historically, a trust was required to file a T3 income tax return only if it met one of a number of parameters, and certain arrangements commonly referred to as bare trusts were excluded from the definition of trusts, and thus from filing requirements, entirely.

Effective for trust years ended December 31, 2023 or later, further requirements were added for a trust to be excluded from the filing requirements, new requirements to disclose substantial information regarding a trust’s settlors, trustees, beneficiaries and certain other persons were added (filed on Schedule 15 ) and bare trust arrangements were also required to file.

Due to concerns that bare trust arrangements were extremely common, and often not recognized as trust arrangements by their participants, significant media attention focused on the administrative burden the obligation to file returns for bare trusts imposed on Canadians in late 2023 and early 2024. CRA waived the filing requirements for bare trusts first for 2023, shortly before the filing deadline, and again for 2024, five months before the filing deadline.

Draft legislation to modify these requirements was released on August 12, 2024. On August 15, 2025, revised draft legislation and explanatory notes were released. Neither of these proposals was ever tabled as a Bill. While these proposed measures would reduce the bare trust arrangements for which filings would be required, many common arrangements would still require T3 income tax returns to be filed, leaving a considerable administrative burden.

Budget 2025 confirmed that the government intends to proceed with the August 15, 2025 proposals, subject to further modifications for consultations and deliberations since their release. However, the application date for reporting by bare trusts would be deferred to apply to taxation years ending on or after December 31, 2026, and not require such filings for the 2025 taxation year.

Avoiding the 21-Year Deemed Disposition Rule for Trusts

Trusts are generally deemed to have disposed of their property for fair market value proceeds on the 21st anniversary of their creation, and every 21st anniversary thereafter (the “21-year rule”). Where property is transferred by a trust on a tax-deferred basis to a new trust, a rule prevents the avoidance of the 21-year rule. This rule prevents transactions that would indefinitely postpone tax on accrued gains. However, certain tax avoidance planning techniques have been used to avoid both the 21-year rule and the anti-avoidance rule. For example, this planning may involve transferring trust property on a tax-deferred basis to a beneficiary that is a corporation owned by a new trust.

Budget 2025 proposed to broaden the current anti-avoidance rule for direct trust-to-trust transfers to include indirect transfers of trust property to other trusts. This measure would apply in respect of transfers of property that occur on or after November 4, 2025.

Non-profit Organizations’ (NPO) Reporting Obligations

The Government stated that it intends to proceed with proposed expansions to the existing reporting requirements for NPOs by requiring basic filings for smaller NPOs not otherwise required to file and adding regular filing requirements for entities with receipts over $50,000. However, this would be deferred to apply for taxation years beginning on or after January 1, 2027 rather than commencing for 2026. The government is reviewing the feedback it received from consultations with stakeholders and will release final proposals in due course with the objective of minimising any additional administrative burden and clarifying which organizations are, or are not, subject to the new requirement.

Various Other Matters

Budget 2025 proposed several other measures, including the following:

- A 2-year pilot project would be conducted to assess whether EI eligibility and entitlement can be determined accurately and securely using real-time payroll information.

- Claimants receiving EI parental benefits would be eligible for an additional eight weeks of parental benefits in the event of the death of the child.

- Temporary flexibility would be provided in respect of the EI Work-Sharing program, as announced on March 7, 2025, to provide benefits to eligible employees who agree to work reduced hours due to a decrease in business activity beyond their employer’s control.

- Temporary EI measures that enhance income supports for Canadian workers whose jobs have been impacted by the economic uncertainty caused by foreign tariffs would be provided.

- The Canada Labour Code would be amended to restrict the use of non-compete agreements in employment contracts for federally regulated businesses, with consultations beginning in early 2026.

- $97 million would be provided over five years, starting in 2026-27, to establish the Foreign Credential Recognition Action Fund to work with the provinces and territories to improve foreign credential recognition, with a focus on health and construction sectors.

- Legislation would be introduced to regulate the issuance of fiat-backed stablecoins in Canada.

- Limits to access the informal procedure in the Tax Court would be reviewed.

- The Proceeds of Crime (Money Laundering) and Terrorist Financing Act would be modified to restrict the acceptance of: cash deposits from one person into the account of another person; and a cash payment, donation or deposit of $10,000 or more.

Budget 2025 also noted that a comprehensive expenditure review was conducted to identify ways to reduce annual spending on an organization-by-organization basis, intended to result in more than $9 billion in savings annually. For example, spending would be reduced in CRA by winding down initiatives such as the digital services tax, the federal fuel charge and the Canada carbon rebate and the underused housing tax. Further, artificial intelligence (AI) and process automation would be used to reduce labour needs in compliance and collection activities.

F. Previously Announced Measures

In addition to items discussed above in conjunction with other proposals, Budget 2025 confirmed the government’s intention to proceed with the following previously announced tax and related measures, as modified to consider consultations, deliberations and legislative developments, since their release:

- Legislative and regulatory proposals released on August 15, 2025, including with respect to the following measures:

- capital gains rollover on small business investments;

- crypto-asset reporting framework and the common reporting standard (subject to a deferred application date of January 1, 2027);

- tax exemption for sales to employee ownership trusts;

- tax exemption for sales to worker cooperatives;

- non-compliance with information requests;

- excessive interest and financing expenses limitation rules;

- substantive CCPCs;

- goods and services tax/harmonized sales tax (GST/HST) rules for the redemption of coupons;

- technical tax amendments to the Income Tax Act and the Income Tax Regulations;

- technical amendments to the Global Minimum Tax Act; and

- technical amendments relating to the GST/HST and excise levies.

- Legislative proposals released on June 30, 2025, to ensure that all Canada carbon rebates for small businesses are provided tax-free, and to extend the filing deadline for the 2019 to 2023 calendar years.

- The extension of the mineral exploration tax credit announced on March 3, 2025.

- Legislative proposals released on January 23, 2025, to extend the 2024 charitable donations deadline.

- Legislative and regulatory proposals announced in the 2024 Fall Economic Statement, including with respect to the following measures:

- exempting the Canada disability benefit from income;

- expanding eligibility under the clean electricity investment tax credit to the Canada infrastructure bank;

- modifying the small nuclear energy eligibility under the clean technology investment tax credit; and

- expanding eligibility under the clean hydrogen investment tax credit to methane pyrolysis.

- Legislative and regulatory proposals to remove the GST on the construction of new student residences released on November 19, 2024.

- Legislative amendments to give effect to the suspension of the Agreement Between the Government of Canada and the Government of the Russian Federation for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income and on Capital under domestic law as of November 18, 2024.

- Legislative and regulatory proposals released on August 12, 2024, including with respect to the following measures:

- alternative minimum tax (other than changes related to resource expense deductions);

- disability supports deduction;

- charities and qualified donees;

- registered education savings plans;

- avoidance of tax debts;

- mutual fund corporations;

- synthetic equity arrangements;

- manipulation of bankrupt status;

- accelerated capital cost allowance for purpose-built rental housing;

- withholding for non-resident service providers;

- regulations related to the application of the enhanced (100%) GST rental rebate to cooperative housing corporations;

- clean electricity investment tax credit;

- expanding eligibility under the clean technology investment tax credit to support generation of electricity and heat from waste biomass;

- proposed expansion of eligibility for the clean technology manufacturing investment tax credit to support polymetallic extraction and processing;

- amendments to the Global Minimum Tax Act and the Income Tax Conventions Interpretation Act;

- technical tax amendments to the Income Tax Act and the Income Tax Regulations; and

- technical amendments relating to the GST/HST, excise levies and other taxes and charges.

- Legislative proposals released on July 12, 2024, related to implementing an opt-in fuel, alcohol, cannabis, tobacco and vaping (FACT) value-added sales tax framework for interested Indigenous governments.

- The proposed exemption from the alternative minimum tax for certain trusts for the benefit of indigenous groups announced in Budget 2024.

- The proposed increase in the lifetime capital gains exemption to apply to up to $1.25 million of eligible capital gains announced in Budget 2024.

- Legislative and regulatory proposals announced in Budget 2024 with respect to a new importation limit for packaged raw leaf tobacco for personal use.

- Tax measures to amend the Excise Tax Act, the Air Travellers Security Charge Act, the Excise Act, 2001 and the Select Luxury Items Tax Act to give effect to the proposals relating to non-compliance with information requests and to avoidance of tax debts announced in Budget 2024.

- Legislative and regulatory proposals released on August 4, 2023, including with respect to the following measures:

- technical amendments to GST/HST rules for financial institutions;

- tax-exempt sales of motive fuels for export; and

- Legislative and regulatory proposals released on August 9, 2022, including with respect to the following measures:

- Technical amendments to the Income Tax Act and Income Tax Regulations; and

- Remaining legislative and regulatory proposals relating to the GST/HST, excise levies and other taxes and charges.

- Legislative amendments to implement the hybrid mismatch arrangements rules announced in Budget 2021.

- The income tax measure announced on December 20, 2019, to extend the maturation period of amateur athlete trusts maturing in 2019 by one year, from eight years to nine years.

- Budget 2025 also reaffirmed the government’s commitment to move forward as required with other technical amendments to improve the certainty and integrity of the tax system. Budget 2025 reflected the cancellation of the previously proposed increase to the capital gains inclusion rate and the Canadian entrepreneurs’ incentive.

Download a copy of the Federal Budget in pdf here.