Navigating the Challenges of Restaurant Bookkeeping

Most people with a flair for the culinary arts aspire to establish their own restaurant or cafe someday. Their underlying motivation is the joy of sharing their flavorful creations with…

How Can Financial Planning Help Farmers Improve Business Efficiency

Farming is a high-risk, capital-intensive business that relies on the climate for its yields. It is common for farmers to see windfall gains in some years and losses in others,…

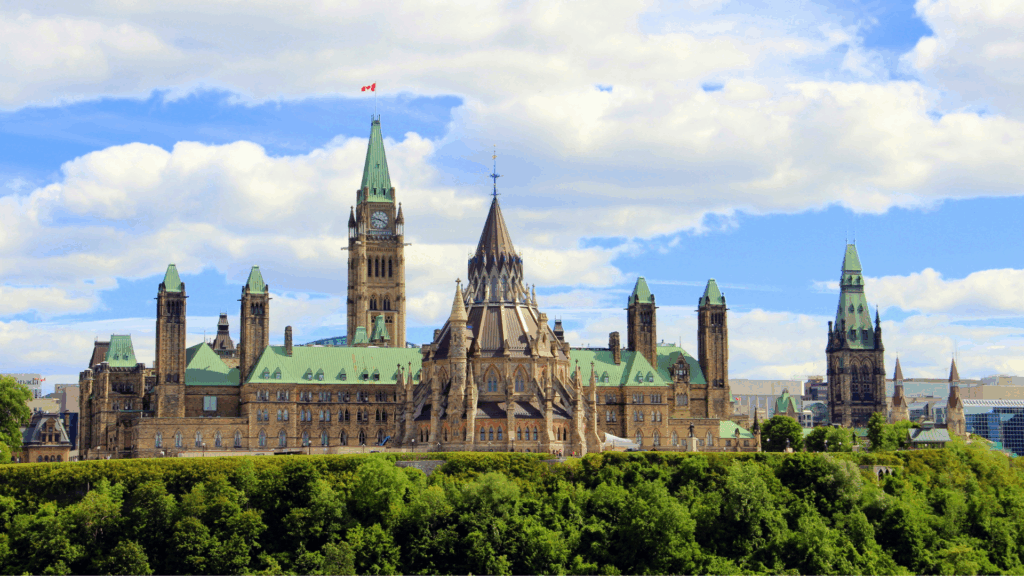

Federal Budget Commentary 2025

Federal Budget Commentary 2025 A. Personal Measures Automatic Federal Benefits for Lower-Income Individuals Budget 2025 proposed to provide CRA with the discretionary authority to file a tax return on behalf…

Can Splitting Pension Income Help Couples Save Tax?

65 is the official age for retirement as per the Canada Revenue Agency (CRA). Hence, you become eligible for several cash benefits and tax credits once you turn 65. You…

Does Your Small Business or Freelancing Work Need a Separate Bank Account?

Most small businesses, sole proprietorships, and freelancers are born in personal bank accounts. At first, work and money come in little irregular bunches. Then, as your work gains recognition, they…

Small Business Owners’ Guide to Track the Financial Health of Your Business

Every financial year begins and ends for a business in the same way: it starts on a note of hopefulness and optimism, only to end in a frenzied panic about…